Limits of liability cover within the port industry have remained largely unchanged for a number of decades, though of recent times the industry has become much more aware of the level of exposures, particularly arising from events that might involve multiple serious personal injury claims.

Inadequate limits present the risk of a body finding itself uninsured for a proportion of a damages award after an incident for which it is liable. That is always a significant risk, but in current times when cash reserves have been depleted coping with the consequences of COVID-19, the combination of that depletion and an uninsured liability would be particularly serious.

Much attention was justifiably drawn to the significant step change in damages values arising from the change in the discount rate in March 2017. That changed a discount rate of 2.5%, in place for more than 16 years, to a rate of -0.75%, which led to massive increases in the cost of claims. The response to that change led to the Government legislating through the Civil liability Act 2018, implementing a new process for setting the rate, but more importantly a new test for the types of investments a claimant should be assumed to invest in, which many assumed would produce an increased rate (which would reduce settlement values) back in a positive territory. As is well known this did not happen and the new rate, effective from the 5th August 2019, remained negative at minus 0.25%. It may well remain in place until the next rate review which must take place no longer than every 5 years. That means we are now only a few years away from possibly a new rate which would reflect the investment climate at that time. Claims outstanding now, and any new claims going forward, could be settled under a new rate from a 2024 review and possibly one which is “more negative” making claims even more expensive. Again, COVID-19 may have an impact here. Some have cited the deteriorating investment climate due to the pandemic as justifying a review much earlier, presumably with the intention of arguing that returns assumed by the rate are no longer achievable. That does not seem to have gained traction but were that argument to succeed and the rate reduced again (more negative) the cost of claims would increase once again.

For now, though, the rate remains at -0.25% in England and Wales.

Note should be taken of the different approaches in the UK jurisdictions Scotland currently adopts a rate of -0.75% (so the level in England and Wales before the change) and adopts a different methodology. In the absence of decisions in Northern Ireland an interim rate change from 2.5% to -1.75% has brought about a massive increase in claims costs where multipliers are now multiples of previous values dependent on the age of the claimant.

On a slightly more positive note, a recent review of UK mortality data has shown that historic predictions for continuing increases in UK life expectancy need to be tempered down. This has had an effect, albeit very slight, on the mortality based multipliers used to calculate damages and hence reducing claim amounts.

However, the impact is most noticeable for older claimants, is marginal for others, and has little mitigating impact on the increased claims costs caused by the change to negative discount rates.

In addition to the movements in the rate, we should not lose sight of the fact that the severity of serious personal injury claims has, for a long time, been subject to year on year substantive inflation. That had become the norm for many years and now acts in conjunction with a discount rate only marginally increased which will continue to push the cost of serious personal injury settlements higher in the years ahead. It is important to take note that there is a delay factor between when claims are notified to insurers and the time at which settlements are reached. During that time the level of claim settlements will continue to rise. Policy limits need to take into account that lag to settlement.

With the most serious cases routinely being presented at upwards of £20m and even £30m in the past couple of years, some liability limits will be exceeded in any event, but the possibility of facing uninsured losses is more acute where there is a risk of multiple claimant events. Such a risk has been particularly associated with the Port industry.

The purpose of this paper is to highlight the increasing levels of exposure and the need for the industry to actively review limits of liability cover as purchased, ‘on a regular basis’.

It is not news that there has been a long term and continuing year on year increase in severity of large personal injury claims. Some examples of the sums involved are given below. Just to illustrate this by two sources of information.

This year on year inflation is not all due to changes in discount rates but due to other factors operating in parallel with them. The rate change affected the multiplier used to calculate personal injury damages. However, year on year inflation is also impacts on the assessment of annual losses to which the multiplier is applied. That would seem to be the case given that the discount rate and hence multipliers (other than for small changes to reflect new data on life expectancy) did not change from 2001 until 2017, during which time year on year inflation of the level set out above was still being observed.

The assumption is, therefore, that there is every likelihood that claims inflation will continue. In part this is down to underlying inflationary pressures that affect all costs, though these underlying rates have been much less than the inflation seen in claims costs. However, it is also due to the manner in which the most serious personal injury claims are presented and awarded.

The year on year change in cost was compounded by the step change increase in costs due to the change in the Discount rate from 2.5% to – 0.75%, a change of 3.25%, and now only partially mitigated by (1) the increase by 0.5% to minus 0.25%, and (2) the slight impact from a review of projected life expectancy which has slightly reduced multipliers.

Just explaining that second mitigating factor: Multipliers used in damages calculations are mortality based – that is they take into account the probability of a claimant living to a certain age (and therefore for what period they need to be compensated).

The Ogden Tables have recently been republished. These tables contain mortality based multipliers (amongst other information) and in the 8th edition account has been taken of recent life expectancy tables published by the Office of National Statistics which show that life expectancy has not increased as much as predicted when the 7th edition was compiled in 2011.

Life expectancy is increasing – just not as much as anticipated and predictions of increases for the future have been tempered. However, although reducing damages values, the overall impact on claims is marginal: life multipliers will reduce by only around 1% – 3% for claimants aged up to 50 and in fact only where claimants are older than that is the reduction of any real significance (though still in the region of 8%-9%)

It follows that we are still only 4 and a half years since damages were awarded at 2.5% and the scale of increase in damages is only slightly reduced now we have moved to a reduction in the rate of 2.75% (represented by the revised rate of -0.25%) instead of the more striking 3.25% (when the rate was set at -0.75%.)

As is well known, the discount rate reflects the anticipated real rate of investment return a claimant can obtain, or is assumed to obtain, on invested damages. It drives the multiplier to be applied to an annual loss to ensure that a lump sum award provides money over the anticipated time of a loss but no more. The consequence of rate reductions of the order mentioned above is to very significantly increase the damages a claimant is awarded. The 0.5% changes (from -0.75% to -0.25%) has reduced damages but only to a level which still remains significantly elevated over historic levels.

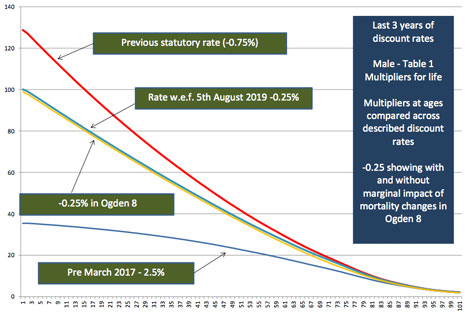

The graph below shows how multipliers varied from those under the 2.5% discount rate in place since 2001 to the highs of the -0.75% rate to now only reduced to a limited extent under the revised -0.25% rate. This remains a valid comparison at this time although as mentioned above, mortality data has slightly reduced multipliers given the slight change that gave rise to.

It illustrates how the cost of claims has increased from a position only a few years ago – the vertical axis is the multiplier against the age of the claimant along the horizontal axis:

To state the obvious, the impact above is essentially a mathematical effect where the same annual losses are multiplied by much higher multipliers. That effect is propelling the value of claims which at the start of 2017, only two and half years ago, would have been valued at £4m to £5m up above the £10m mark; claims previously £10m plus are now possibly going to exceed £20m, and for the youngest of claimants the high level of multipliers will still drive significant settlement sums (see later).

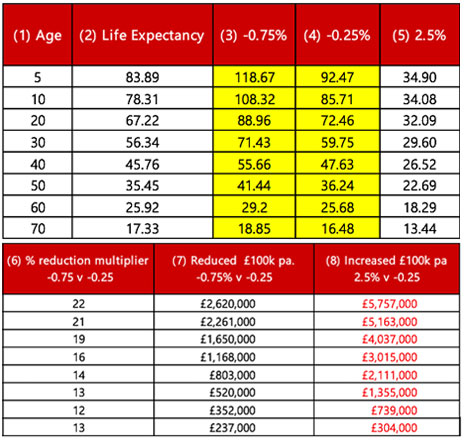

The table below is a useful indicator showing for male lifetime losses the impact on each £100,000 of damages for future loss at various ages just through the change in rate:

The table shows that whilst the change from -0.75% to -0.25% has produced reduced multipliers (columns 6 and 7) and (for every £100k of future loss) reductions in claims costs, this still have to be put in the context of the cost at a 2.5% rate where sizeable increases still result from a minus 0.25% rate (column 8).

This factor and year on year inflation combined, means that the level of funds required to be held by an insurer to cover the costs associated with such claims has had to increase, but at the same time risk managers need to be aware that the adequacy of limits under liability covers.

Exceptional personal injury cases have in the past reached the mid £20ms.

Examples would be:

These were cases with exceptional features. The problem we face now is that such figures are now being pleaded more frequently, particularly under the existing discount rate and will reduce but not significantly under the new one.

The 2017 case of JR v Sheffield Teaching Hospitals NHS Trust (better known for the decision about accommodation costs under the Roberts v Johnstone rule and now the subject of an adjourned appeal) provided a detailed breakdown of the heads of loss, multipliers and periodical payments. That indicated a comparable lump sum value of £24m for a 24 year old brain injured claimant injured at birth.

In May 2019 the media carried reports of “the highest ever personal injury award” with a £45m figure mentioned as the settlement amount. In reality the claim involving a 7 year old ventilator dependent tetraplegic was settled with a combination of a lump sum and an annual periodical payment of £950,000, so the £45m was an attempt to assess the value on a 100% lump sum basis and much depended on the claimant’s life expectancy, but the potential for lump sum assessments to reach these levels is made out.

Regularly, the press and law reports produce attention grabbing cases. Tragically many involve very young people sustaining catastrophic injury at birth or shortly thereafter. However, they show the potential damages now available where very severe injuries are caused to people of younger years:

Reference was made earlier to the long stop 5 year review of the discount rate in England and Wales. A review of the rate in Scotland will also take place at that time. In the absence of any circumstances that require an earlier review that is the latest date that a review can take place. It will fall due in Q3 2024, 3 years away.

The life cycle of serious personal injury claims would mean that many known claims, and more certainly new claims going forward, would settle after a review had taken place. Whilst it is possible that a review could lead to an unchanged discount rate, or theoretically an increased rate (lowering multipliers and hence damages), any further reduction in the rate would pose a further inflationary increase on the level of damages.

In mid 2021 Ernst Young produced a UK Motor Insurance Market results report which indicated that investment returns on the types of assets taken into account when setting the discount rate are likely to be around 0.5% to 1% lower in 2024 then when the rate was set. If that was so, and if coupled with a more pessimistic view of the inflation of costs covered by awards of damages, a significant further decrease in the rate could arise. Damages would increase accordingly.

The discount rate in Scotland was set at -0.75% in October 2019. A rate identical to that in England and Wales before the rate reduction as a consequence of the new approach.

Northern Ireland is a special case at the moment still going through stages to decide how to approach the discount rate in the future. In the meantime a rate has been set which will make claims in Northern Ireland very expensive until the rate is changed (if in fact it is reduced).

On 31 May 2021 the Damages (Personal Injury) Order (Northern Ireland) 2021 brought in a personal injury discount rate of -1.75%. That was derived by following the approach which existed previously in England and Wales. The interim rate was particularly striking given that prior to it the rate in Northern Ireland had been 2.5%. A swing of 4.25% in the rate.

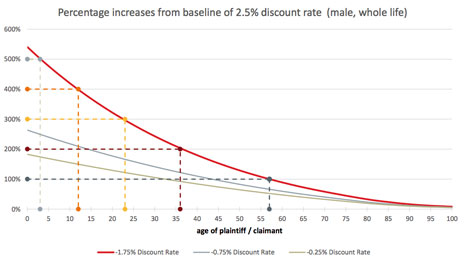

The graph below shows the effect on multipliers by claimants age – given the multiplier is multiplied by the annual loss the effect is a massive increase in damages costs:

At a discount rate of -1.75% as opposed to the previous NI rate of 2.5% whole life multipliers will:

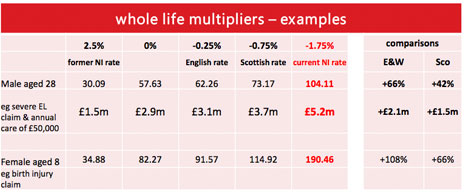

The table below provides a comparison between the historic 2.5% discount rate, the much lower Northern Ireland rate and current rates in England/Wales and Scotland.

Ports operating in Northern Ireland present particular risks with regard to the level of damages and possible inadequacy of policy limits.

The effect of the increases will be most acute where risks and insurers are exposed to multiple claimant cases. Motor insurers can face the prospect of multiple serious and catastrophic injuries in one incident. However, any risk particularly within the entertainment, leisure or transport sectors, which can face multiple casualty events, will increasingly face this aggregating factor. The probability of such an event, its cost and the limits held under liability covers will now become an issue of close focus for such risks and those advising them.

The nature of port operations has always been perceived as high risk by the insurance industry, based upon empirical data as accumulated over many years. This has largely been as a result of the hazards as associated with stevedoring operations. It has also followed on from such incidents as occurred at Ramsgate in 1994, whereby a walkway collapsed causing the death of 6 people and serious injuries to 7 others who feel onto a steel platform below the walkway. The resultant claims from the latter quoted incident resulted in a total settlement of £12m. It has been estimated by those involved in the claims which arose, that a similar style of incident / settlement today would result in an award in excess of £500m.

The international nature of the claimants can increase the damages and legal costs associated with such claims – the victims of the Ramsgate event were British, French, Italian, Belgian, Italian and American. Other walkway collapses have occurred more recently, including one in the U.K. in 2015, though luckily this did not involve any serious injuries. Should the latter mentioned accident have happened an hour before the time period when it occurred, it would have resulted in a high number of deaths and serious injuries.

Indicative of the scale of the risk of multiple casualties, a 2005 Paper “a survey of accidents in ports” published in Loss Prevention Bulletin, detailed a survey of 144 accidents with one or more deaths that occurred in ports up to October 2003. The survey indicated 85% of those incidents with between 1 and 10 deaths but 13% between 11 and 100 deaths. The report went on to say that “accidents with a number of deaths between 101 and 1000 or higher than 1000 must be considered atypical”, though reference was made previous famous accidents such as Halifax (1917, 2,000 casualties), Bombay (1944, 1,377 victims) and Port Chicago (1944, 321 deaths). Although these incidents would have taken place during an age of different technological and safety environments, they nevertheless illustrate the potential for high casualty events. Looking at injury as opposed to death, but where the damages costs are usually much higher, the survey indicated 174 accidents 72% of which involved between 1 and 10 injured persons, and 24% between 11 and 100 injuries. Even with severity at the lower end, an event with c. 10 casualties, some of whom have serious or catastrophic injury, represent significant liabilities at current damages levels.

It must be noted that due to the nature of the nature of port operations, one is unlikely to eradicate the possibility of personal injury claims occurring, due to the level of public access granted. This can be evidenced by the nature of cruise and ferry operations, which involve large numbers of people traversing port properties.

Many smaller / purely cargo handling ports possess limited exposures, based upon limited public access being granted to third parties. Even so, the limits of third party liability cover as held by such ports would prove insufficient to meet the cost of a serious personal injury claim in the light of the changes discussed above. The situation is very different with ports possessing cruise / ferry operations present within their operational structures. Given the nature of such operations, the possibility for a number of injury / death claims occurring as a result of a single incident is much more substantial.

In order to assess suitable levels of cover, one would require gaining a full insight as to the nature of the port’s operations at the ‘busiest times’. Whilst without such an analysis, suitable limits of cover would be difficult to assess, they clearly lie above those currently in place. Clearly limits of circa £40m might only be sufficient to cover a single maximum severity injury claim, with a serious risk of being uninsured in respect of a multiple claimant event. The MAIB report into the 2010 Heysham walkway collapse recorded that a party of 26 school children were about to enter onto the walkway and were only held back by the chance decision to wait for one of their number to catch up. A tragic event was averted but were a similar case to arise now, the combination of year on year inflation and the discount rate change would produce a total claim cost exceeding most covers.

Whilst the cost of such insurance cover must be borne in mind, it would be wise for ports handling large numbers of people, to consider a base minimum level of cover. Whilst suggesting a figure is largely guesswork, one might suggest a very minimum of £100m.

The discount rate, year on year inflation and the risk of multiple claimant events all bear on suitable levels of cover as required. It is a combination of these factors which should be borne in mind by risk managers, when considering adequate levels of insurance cover.

Robert Iremonger.

Abingdon Risk Consulting / November 2021

(Written in conjunction with lawyers at BLM, the leading UK insurance and risk law firm.)

After reading about what we can do for you, are you ready to get started? Do you have any questions?

Contact Us